M&S reported its full-year results on Wednesday but while they’re usually closely watched, what most people want to hear was how much the recent cyberattack is costing it. The answer? A cool £300 million in current year operating profit. But that’s before management of costs, insurance and other trading actions that should lessen the pain and it even managed to find some plus points in the actions the attack has forced on it.

The company said it entered the new financial year at the end of March “with strong trading momentum, with both Food and Fashion, Home & Beauty trading ahead of budget”.

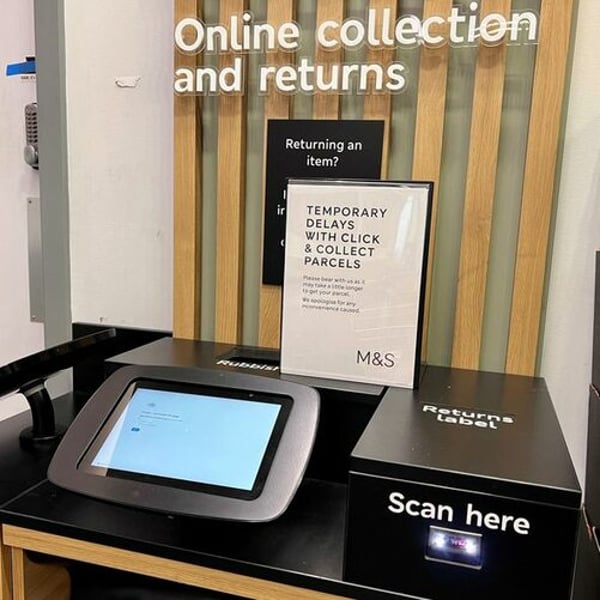

But with April’s “highly sophisticated cyber incident” it closed its webstore to new orders, shaken up its systems and has been generally focused on working “around the clock with suppliers and partners to contain the incident”.

Interestingly, it said it’s “seeking to make the most of the opportunity to accelerate the pace of improvement of our technology transformation and have found new and innovative ways of working”. If ‘life gives you lemons, make lemonade’, as they say — or maybe ‘what doesn’t kill you makes you stronger’!

M&S said it’s “focused on recovery, restoring our systems, operations and customer proposition over the rest of the first half, with the aim of exiting this period a much stronger business”.

It added that Fashion, Home & Beauty, online sales and trading profit “have been heavily impacted by the necessary decision to pause online shopping, however stores have remained resilient. We expect online disruption to continue throughout June and into July as we restart, then ramp up operations. This will also mean increased stock management costs in the second quarter”.

Strong year as fashion rises but international ops down

So what about those results? The year to late March was the “third consecutive year of growth and strong balance sheet”.

Profit before tax (PBT) and adjusting items was up 22.2% at £875.5 million, the highest in over 15 years. But statutory PBT was down 23.9% at £511.8 million.

The company operates a huge Foods division with sales and profits there rising strongly. Meanwhile Fashion, Home & Beauty sales were up 3.5% to £4.2 billion and its adjusted operating profit rose to £475.3 million from £437.5 million.

But International constant currency sales were down 7.1% to £0.7 billion and adjusted operating profit dipped to £46.3 million from £47.8 million.

M&S said its Food volume and value share growth has continued for three years with like-for-like (LFL) sales up 8.6% in the latest year. Fashion, Home & Beauty has also seen value share growth for three years with LFL sales up 4.4%. The International division is “resetting for future growth, developing a capital-light operating model”.

CEO Stuart Machin said the Fashion, Home & Beauty strength came as “our authoritative lead in quality and value perception and much improved style credentials broadened [its] appeal and [grew] market share. This renewed strength in product gives us the foundation to drive future growth through transforming our end-to-end supply chain and accelerating online”.

This growing interest in its offer appears to be working across categories. In the latest year, women’s and men’s grew in categories such as jeans, knitwear and tops, with strong seasonal campaigns and collaborations helping to drive style perceptions.

It premium Autograph label’s sales grew 47% “as customers invested in higher-quality, versatile products at the top end of the range”. Men’s Autograph sales of around £200 million compared with just £50 million three years ago.

In a declining kidswear market, there was growth in baby and market share growth in kids’ casual. A ‘first price, right price’ approach is being implemented, removing promotions and offering competitive prices on everyday essentials.

Home saw good growth in collaborations such as Kelly Hoppen, and beauty grew own brand fragrance sales. “Both offer significant potential for long-term growth and are being refocused under new leadership,” it explained.

Online ups and downs

The retailer added that pre-cyberattack, it was seeing “early improvements to online but further improvement is required”.

Online sales, adjusted for the exit of furniture, represented 34% of sales. Growth was driven by active customer growth of 9% to 10.2 million, as marketing was refocused towards brand and social channels.

Improvements to the offer included upgraded imagery, navigation and availability in smaller sizes.

Partner brand fashion sales online increased 42%. Recent top-tier brand additions included Hush, Tommy Hilfiger and Calvin Klein. The overall brands business exceeded £200 million sales for the first time in 2024/25.

But results for the current year won’t be as good as they’ll be hit by the webstore closure. And it added that even without this big headache, “there remains a lot more to do to create a market-leading online business. Further work is needed in planning, ranging, in-store selling, delivery and fulfilment to drive online towards an ambition of 50% of Fashion, Home & Beauty sales in the medium term”.

Physical stores news was good though with the financial year having seen, two new Full Line stores at Dundee and Washington Galleries with their Fashion, Home & Beauty sales trading 15% ahead of plan. Fosse Park was extended during the year, with Fashion, Home & Beauty trading up 20% versus last year.

And the Battersea fashion-only trial store opened in December 2024, “generating strong customer and partner interest and will provide inspiration for future renewal stores, including The Pantheon on Oxford Street”.

As for the International operation, the ambition is “to build a global omnichannel business, which brings the magic of M&S to customers around the world. Utilising the expertise and infrastructure of strategic franchise partners in established markets, working with leading marketplaces to drive online growth, and securing new opportunities in wholesale”.

While sales fell, as mentioned, performance started to improve in the second half. Owned sales were down 8% driven by weak trading in India. And Franchise sales were down 5.2%, driven by partner destocking in Fashion, Home & Beauty, although this was partly offset by growth in Food. Operating profit before adjusting items was slightly down versus last year at £46.3m (margin 7.0%) from £47.8m (2023/24: 6.6%), with an improved result in the second half.

The joint venture in India is being reset under new leadership, shifting to a full-price trading approach and starting to reduce costs.

Copyright © 2025 FashionNetwork.com All rights reserved.