2024 was a year of “transition” within the Clarks business “as internal and external factors created a variety of challenges”, its owner said in its latest results filing at Companies House.

The parent company of the Clarks brand, C&J Clark (No1) Limited has filed its figures for the full 2024 financial period and said that the headwinds the now-200-year-old company faced in 2023 continued last year. That meant its full-price and outlet stores in both the UK and US performed below expectations.

Key figures included group revenue down 9.4% to £901.3 million, although the cost of sales also reduced. Gross profit fell 10.2% to £432 million and the group operating loss was £18.1 million, smaller than the £20.3 million equivalent loss in 2023. The pre-tax loss varied only slightly this time at £39.2 million (compared to £39.8 million in 2023) and the loss after tax widened to £39.3 million from £32.1 million. However, the figures were impacted by a number of exceptional costs adding up to £52.1 million and profit before these exceptional cost was £12.8 million.

So what were the exact challenges the business faced? It cited a tough global market and uncertainties for both businesses and consumers over potential shifting trade policies because of major elections taking place in countries like the UK, US, India, several EU nations and emerging markets.

Coming on the back of continued major conflicts and inflationary pressures, the company said it led to reduced consumer demanded during the year.

But the group didn’t sit still and, as mentioned, FY24 was a year of transition as it focused on cost rationalisation and reduction to “fix the foundations for our future”.

Significant changes were made to operations during the year to “right size” overhead costs, refocus its marketing approach, reposition its products assortment and set up the business for “recovery and sustainable profit growth” in 2025.

But consumers made it a tough period as they continued to be “very cautious” in their spending with “a greater appetite for lower price points”. This meant soft retail sentiment with lower traffic in-store and lower sales conversion compared to the previous year, as well as lower-than-expected margins due to continuous promotional activity. But in the second half, “retail momentum gradually improved with the focus on marketing and merchandising initiatives as well as clearance and new assortment plans”.

The company’s wholesale performance was in line with the previous year with the US region continuing to be the largest wholesale market. In the UK, sales volumes benefitted from off-price deals that are used to clear old inventory, but this dented margins. However, the higher volumes offset a shortfall in EMEA as a result of underperformance in some European countries, with the market and many wholesale customers continuing to be overstocked leading to lower stock replenishment.

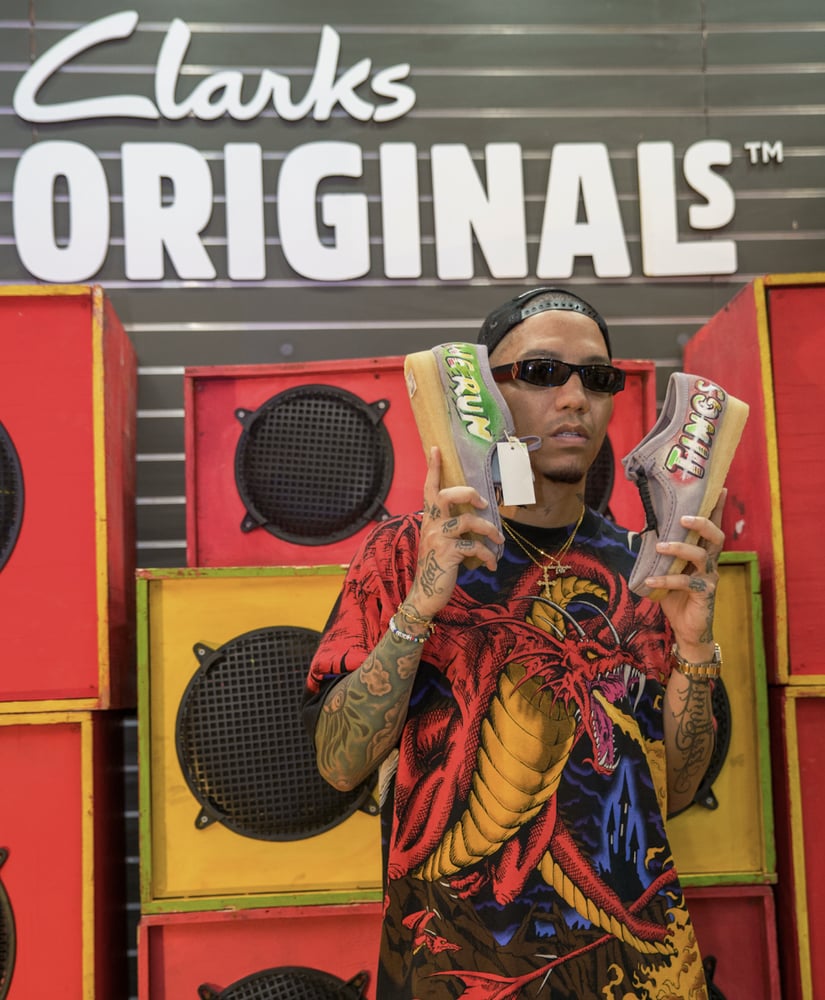

APAC saw increasing consumer demand across DTC channels with the performance trending up in Q2 from full-price stores in particular and the stores traded positively across all markets. This was driven by strong average selling prices and increased football during key holidays. To capitalise on increased demand for Clarks Originals in the region, new doors were opened in China and Hong Kong after the success of the premium Clarks Original concept that first opened in Japan in 2023.

The company also developed product specifically for China with the first product successfully launched last year.

Changes at the company itself included CEO John Ram leaving in April 2024 and an interim executive committee formed reporting to the board. It also reorganised its global leadership team to simplify its structure and centralise costs. And it focused heavily on cost savings.

Those savings included reduced headcount across all functions, relocating finance, costings and IT support teams to the lower-cost location of Malaysia. It consolidated warehouse operations in Europe by closing its EU distribution centre and servicing the market from its own warehouse in Street, Somerset. And it closed its Singapore office and moved the Southeast Asia team to Malaysia.

The product assortment was repositioned too and it looked at pricing in order to become “a better-value proposition” in each market as well as rolling out an essentials range in the UK “to serve price-conscious customers”. That also came with a change in marketing approach to drive traffic to stores and online, as well as reinforcing key brand values of comfort and fit.

To kick-start future growth the company is focusing on profitable market share growth in its mature markets of the UK, the US and EU but will build scale with “aggressive” growth rates in its less established markets. It will invest in key growth opportunities and is building and sourcing “appropriate” assortments per market with, as mentioned, suitable pricing for the consumer.

Copyright © 2025 FashionNetwork.com All rights reserved.